Time to invest in property in Marbella

Investors and developers, invest your money today in a healthy real estate market with attractive appreciation of capital in the foreseeable future. Homebuyers, consider taking advantage of the current price level before it increases further.

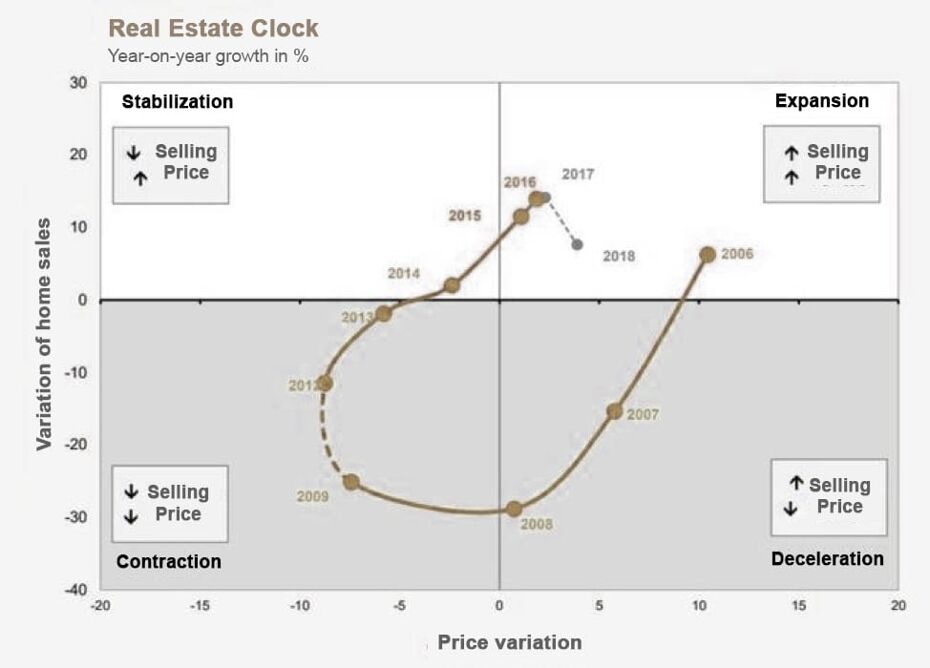

Tic, tac ... the real estate clock does not yet mark the end of the current market boom.

Ten years after the property market crash and with several cities including Marbella having an obvious increase in demand, the thoughts return to the changes in the residential market.

According to the experts, there is still by no means symptoms of slowdown. Although like any cyclical market, sooner or later there will be a change in trend that could take place between 2021 and 2023 depending on different factors such as the economic situation, the creation of employment or the evolution of interest rates. What is unanimous is that when it does come to an end, unlike what happened a decade ago, it will be much smoother.

The housing market in Spain is cyclical and goes through different phases: expansion, deceleration, contraction, and stabilization. According to CaixaBank, these phases take place in a clockwise direction and according to their forecasts, at present we are in full expansion characterized by increases in prices and transactions, the next phase would be around the corner as the graph below shows.

Source: CaixaBank Research based on data from the INE and the Ministry of Development. Note: excludes the period 2010-2011 due to the effect of tax incentives.

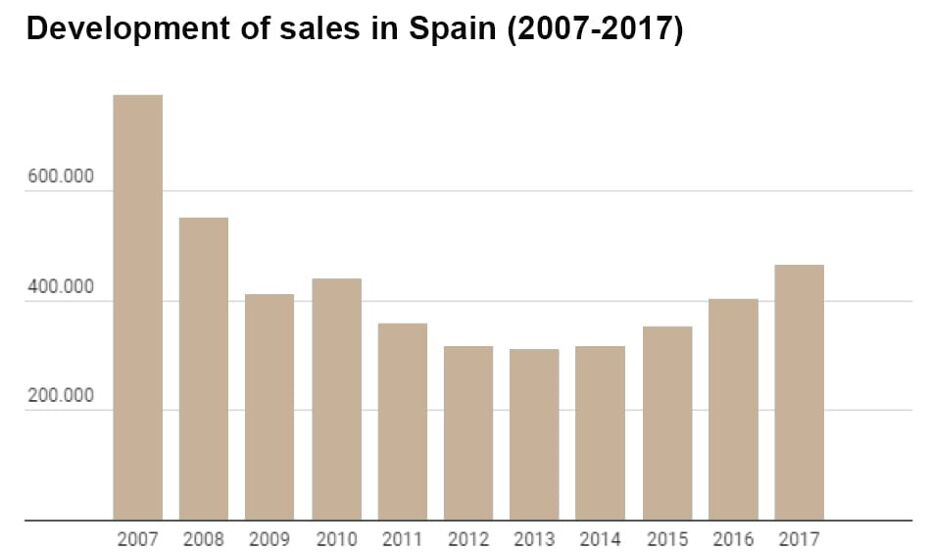

In Spain, experts estimate price increase of 11% in 2018 and in sales of more than 20%, excluding only Barcelona, Madrid and some coastal areas where prices may stabilize by 2019. This forecast coincides with those of Juan Fernández-Aceytuno, expert, and CEO of Sociedad de Tasación.

Source: National Institute of Statistics (INE).

In the latest data from the National Institute of Statistics (INE), sales rose by 16.2% in February compared to the same month in 2017, to 41,480 operations its highest figure in this month since 2011. Home prices registered an interannual increase of 7.2% according to Eurostat in the fourth quarter of 2017, accelerated from 6.7% in the third quarter, representing the highest increase in a decade.

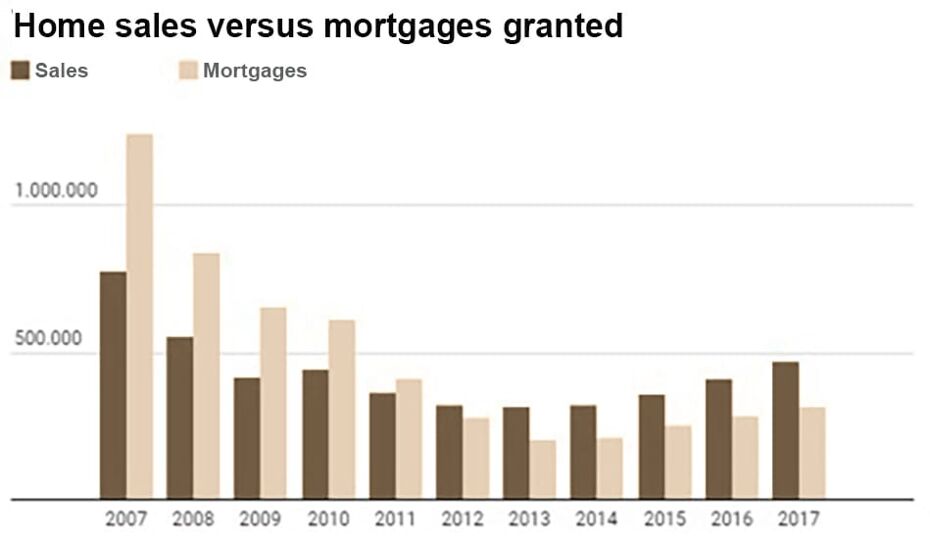

Source: National Institute of Statistics (INE).

The figures are especially bullish in large cities such as Madrid or Barcelona, as well as in certain coastal areas and islands, while there are still many places where the market remains negative. This is in great difference compared to the last expansion phase when both sales and prices rose in all of Spain.

What indicators could anticipate a change in trend? The number of mortgages exceeds the volume of transactions, a situation that has not occurred in Spain since 2011.

Source: National Institute of Statistics (INE).

Also, the mortgage outstanding balance, that is the amount of write off loans is higher than the number of new mortgages. Don’t forget the relationship between the price of housing and land or the growth of GDP with the affiliation to social security.

During the last three years, GDP and affiliation data have increased at an annual rate of 3%, while in the last two years, the price of new housing has grown at par. A decade ago, housing grew well above the other two variables mentioned here above. The economy and affiliates grew at 3 and 2%, while housing grew at 15 or 18%. When any of these alarms go off, we could be on the threshold of the deceleration phase of the sector.