Euribor. Mortgage Rates in Marbella

Have a mortgage, pay attention: the Euribor closes August with the largest increase in four and a half years

The 12-month Euribor continues in negative territory for the joy of those with a variable mortgage, although its development during August has once again made it clear that the reference indicator for most mortgages in Spain is in full change of trend.

Specifically, the eighth month of the year ended at -0.169%, the highest level since last September and the sharpest rebound since spring 2014 (July ended at -0.18%). This is the fifth consecutive rise (the last time it fell was last February), which response to the market's expectation that the European Central Bank (ECB) will begin to raise interest rates in the eurozone after next summer. So far, many analysts set September 2019 as the date for the highest monetary and financial authority in the common currency region to decide and introduce this raise for the first time since autumn 2011. Being the first rise in eight years.

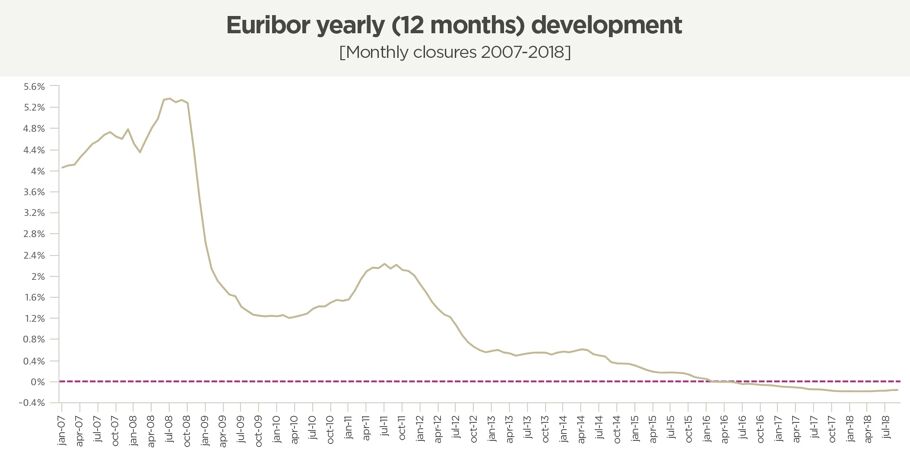

In the last decade, the Euribor has broken different records. It reached its maximum level in the summer of 2008, when it exceeded 5.3%, while in February 2016 it entered the negative territory and remained in the minimum zone. In February and March of 2018, it pulverized the lowest level in history when it stood at -0.191%, but since then it has turned around to gradually approach zero.

Despite the current rise, the 12-month Euribor is lower than a year ago: it closed August 2017 at -0.156%, which means that those who have to revise soon their conditions of a variable mortgage, will benefit from a decrease in the monthly fee.

Without a doubt the rebates on mortgages are about to hit rock bottom, the 12-month Euribor in daily rate is already around -0.165%, which shows that the upward trend has come to stay.