Dutch Rental Market Changes 2024: Why Investors Are Moving to Marbella

Dutch Rental Market Changes 2024 are in full effect as the rental market undergoes rapid changes due to new regulations, making it harder for investors to maintain their returns. As a result, many investors are now looking to southern Spain, where cities like Marbella offer ample opportunities for those seeking flexibility and growth potential in a more stable real estate market

Affordable Rental Law Changes the Investment Climate

With the introduction of the Affordable Rental Law on July 1, 2024, the Dutch government has sent a clear signal: rental prices in the mid-segment must decrease. The law introduces a new point system, the Housing Valuation System (WWS), to guarantee maximum rental prices, impacting landlords' potential returns.

These regulations make owning rental properties less attractive for investors, leading many to explore other options. One attractive choice is investing in Spanish real estate, where properties experience more stable growth without the strict limitations of the Dutch market.

What Exactly Does the Affordable Rental Law Entail?

The Affordable Rental Law is designed to make rental housing in the Netherlands more affordable for the average tenant. Previously, only social housing was protected by the WWS; as of July 2024, this also applies to many mid-range rental properties. The law stipulates that properties with a WWS score up to 186 points can charge a maximum rent of €1,157.95 per month. As a result, even free-market rentals are affected, with a significant impact on the market and investors.

Amsterdam as an Example of Rental Prices Before the New Law

To understand the context, it’s useful to look at the situation before this Affordable Rental Law. In Amsterdam, for example, rental prices rose sharply between 2015 and 2023. A one-room apartment of just 20 square meters could cost €1,200 to even €2,000 per month, making renting unaffordable for many. Students and working individuals were forced to leave the city or settle for subpar accommodations. For investors, however, this presented opportunities for high returns, especially in the mid-segment.

The New Rules and Impact on the Investment Climate in the Netherlands

With the implementation of the Affordable Rental Law, regulations have tightened, resulting in immediate financial consequences for many landlords:

- Maximum Rent Prices: Properties with fewer than 186 WWS points are subject to a maximum rental price.

- Mandatory Point System: This is required for all new contracts, preventing rental price inflation.

- Enforcement by Municipalities: Starting January 1, 2025, the government will enforce the law, and landlords who fail to comply with the WWS will face fines.

These changes mean that landlords in cities like Amsterdam, Utrecht, and Rotterdam must significantly reduce rental prices, limiting their income.

Declining Returns and Growing Interest in Spanish Real Estate

Previously, investors achieved attractive returns from their Dutch rental properties, but this outlook is changing rapidly. The costs of owning rental properties in the Netherlands are increasing due to additional regulations and taxes, while rental income is decreasing. The Dutch Central Bank estimates that the loss of returns for investors in the free sector could reach up to 30% in cities like Amsterdam. This explains why many property owners are now selling their assets and reinvesting in a more favorable investment climate, like the Spanish real estate market.

Why Spain is an Attractive Market for Real Estate Investors

Spain offers an appealing alternative for Dutch investors due to the stability and freedom in the real estate market. Unlike the Netherlands, Spain has fewer rental price regulations, allowing for higher potential returns. Investors benefit from a stable demand for luxury properties from tourists and expats without the limitations of the Dutch WWS point system. Additionally, the tax rules for property ownership in Spain are relatively favorable, making it even more attractive for foreign investors.

Best Place to Invest in Spain

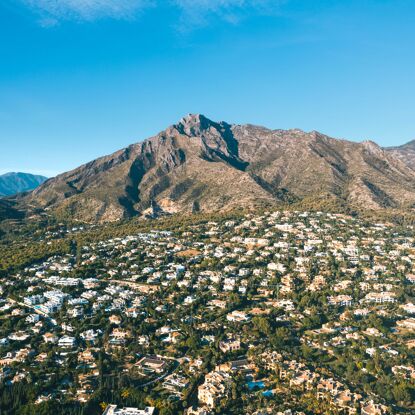

Southern Spain, especially the Costa del Sol, is a hotspot for investors, with Marbella as a standout location. Marbella offers an attractive combination of climate, lifestyle, and a strong demand for luxury homes for both vacation rentals and long-term stays. This makes Marbella the best place to invest in Spain, especially for those seeking high returns and flexibility in their real estate portfolio.

Advantages of Investing in Spain:

- More stable returns due to a less regulated rental market.

- Flexibility in rental types, such as short-term rentals to tourists.

- Strong demand for luxury real estate from expats and international buyers.

Figures and Facts: How Big is the Potential Profit?

| Feature | Netherlands | Marbella |

|---|---|---|

| Maximum mid-range rental price | €1,157.95 | Free, depending on market value |

| Housing Valuation System (WWS) | Yes | No |

| Regulatory Taxes | Yes | More favorable for foreign investors |

| Rental Restrictions | High | Low |

| Tourist Demand | Low | Very high |

The table clearly shows that the potential for better returns in Marbella real estate is significantly higher, without the restrictions imposed by the Affordable Rental Law’s point system in the Netherlands. Investing in Spain is therefore highly attractive.

What Does This Mean for Investors?

With the implementation of the Affordable Rental Law, it is becoming increasingly difficult for investors in the Netherlands to achieve returns. They must comply with a detailed point system and respect the rent price per WWS point, which reduces the financial appeal of Dutch real estate and prompts investors to reconsider their strategies. Selling property in the Netherlands and reinvesting in the less regulated Spanish real estate market offers a logical and strategic choice. Marbella not only provides returns but also a certain degree of stability, allowing investors to benefit from both tourist demand and rising property prices.

Are There Risks to Investing in Spain?

As with any investment, there are risks, and Spanish real estate is no exception. Important considerations include fluctuations in tourism, dependence on the global economy, and possible tax reforms in Spain. However, these risks are largely offset by the advantages, especially compared to the current limitations on the Dutch market.

Risk Considerations for Investing in Spanish Real Estate:

- The Spanish real estate market is partly dependent on tourism, which can fluctuate. Choosing to invest in Marbella minimizes this risk, as tourism here thrives year-round.

- Local regulations may change in the future, though this is unlikely in the short term.

- Currency fluctuations may impact the conversion of profits.

Opportunities in the Spanish Real Estate Market

In recent years, the Dutch rental market offered opportunities for investors, with rising rental prices and a shortage of mid-segment housing. The introduction of the Affordable Rental Law drastically changes this dynamic, with lower returns and higher requirements for landlords. Many investors now consider selling their Dutch rental properties a logical step. And the Spanish real estate market in Marbella presents a highly attractive alternative. With less regulation and higher demand for luxury housing, Marbella is a logical choice for investors who want to optimize their returns and diversify their risks.

Opportunities with Drumelia Real Estate: Invest in Flexibility and Growth

With the new Dutch rental regulations, the investment climate is changing drastically, and Drumelia Real Estate Marbella offers an attractive alternative for investors looking to maximize their returns.

Drumelia Real Estate has a diverse portfolio of properties suitable for personal use, seasonal rentals, or real estate development. Whether you're seeking returns in a growth market or the flexibility of property in a vacation paradise, Drumelia Real Estate Marbella will guide you every step of the way. Are you ready to let your investment flourish in a stable and thriving market? Explore our selection of luxury homes and discover the investment opportunities under the Spanish sun.